Bitcoin & Ethereum 2025: Price Predictions, ETF Updates, and Market Trends

As we move further into 2025, the cryptocurrency market continues to evolve at a rapid pace. Bitcoin (BTC) and Ethereum (ETH), the two most dominant cryptocurrencies by market capitalization, remain at the forefront of this digital transformation. With the approval of spot Bitcoin ETFs in key markets, Ethereum’s push toward scalability with Proto-Danksharding, and macroeconomic factors influencing adoption, let’s dive into the key trends and predictions shaping BTC and ETH in 2025.

Bitcoin: Institutional Confidence and ETF Momentum

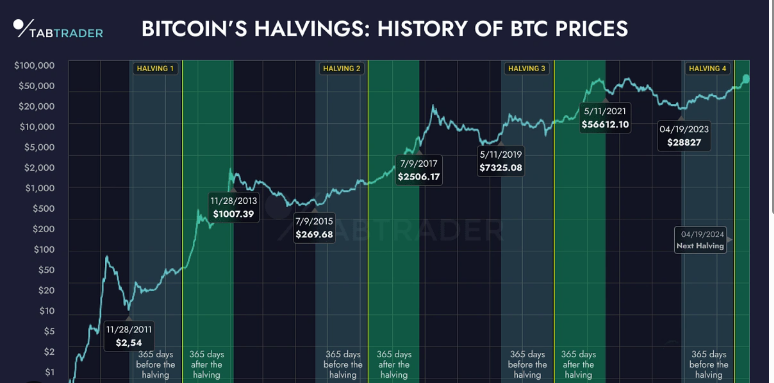

Bitcoin started 2025 with a strong upward trajectory, breaking past key resistance levels and stabilizing around the $70,000–$75,000 range in Q1. Much of this momentum can be attributed to the continued inflow into spot Bitcoin ETFs, which were approved in the U.S. in early 2024. These ETFs have provided institutional investors with a regulated pathway to gain exposure to BTC, injecting billions in liquidity into the market.

Key ETF Trends in 2025:

- Institutional demand is rising — large firms like BlackRock and Fidelity continue to report increased holdings in their Bitcoin ETFs.

- Global expansion — countries like the UK, Singapore, and Brazil are now exploring similar regulatory frameworks for Bitcoin ETFs.

- Retail adoption is increasing as ETFs lower the barrier to entry for new investors.

Bitcoin’s status as a “digital gold” continues to strengthen, especially amid ongoing concerns about inflation and fiat currency devaluation. Analysts at Bloomberg and Ark Invest have revised their BTC price targets, suggesting a potential range of $100,000 to $150,000 by the end of 2025, depending on macroeconomic stability and geopolitical events.

Ethereum: Upgrades and Real-World Use Cases

Ethereum, the second-largest crypto by market cap, has also seen significant development. The shift to Ethereum 2.0 and the successful implementation of Proto-Danksharding (EIP-4844) has greatly enhanced scalability, paving the way for lower fees and faster transactions.

Notable Ethereum Trends in 2025:

- Layer 2 dominance: Rollups like Optimism, Arbitrum, and Base are now handling a majority of transactions, reducing mainnet congestion.

- Enterprise adoption: Ethereum is increasingly used for real-world applications such as tokenized assets, supply chain tracking, and decentralized finance (DeFi).

- ETH ETFs: Several financial institutions have launched Ethereum-based ETFs following BTC’s path, further legitimizing the network.

Ethereum is positioning itself not just as a cryptocurrency, but as an infrastructure layer for Web3. Price predictions for ETH in 2025 vary widely, ranging from $6,000 to $10,000, with some bullish analysts pointing to increased staking and reduced issuance as supply constraints that could drive prices higher.

Market Sentiment and Regulatory Developments

The regulatory landscape in 2025 is more mature, albeit still fragmented. The U.S. Securities and Exchange Commission (SEC) and other global regulators have introduced clearer frameworks for crypto taxation, securities classification, and compliance. This has provided more certainty for institutional players while helping protect retail investors.

Key policy shifts:

- MiCA framework in the EU has become a model for balanced crypto regulation.

- Asia-Pacific is emerging as a crypto innovation hub, led by South Korea, Japan, and Hong Kong.

- U.S. regulation remains strict but clearer, encouraging companies to stay within borders rather than relocate offshore.

Macro Trends Driving the Market

Several macroeconomic and technological factors are fueling optimism in the crypto space in 2025:

- Global inflation remains a concern, making BTC more attractive as a hedge.

- AI and blockchain integration is accelerating innovation in decentralized applications.

- CBDCs (central bank digital currencies) are pushing more users toward decentralized alternatives like BTC and ETH due to privacy concerns.

Conclusion: The Road Ahead

2025 marks a transformative year for both Bitcoin and Ethereum. With institutional investment surging, technical upgrades streamlining usability, and regulatory clarity improving globally, both assets are well-positioned to lead the next wave of financial innovation.

While price predictions remain speculative, the underlying fundamentals for BTC and ETH are stronger than ever. As adoption increases across industries and geographies, investors and developers alike are paying close attention to the evolving landscape of the crypto ecosystem.